The Paris Agreement and last year’s COP26 have accelerated the use of sustainable technologies for economic development. While there are ample technologies available to reduce greenhouse gas emissions, adoption is slow due to a lack of funding. Such a scale of finance can only be met by the financial markets, particularly bond investors. Apropos, Swiss asset manager Pictet recently published a report titled “Bonds that build back better” — explaining how green initiatives are raising money, especially from the fixed income markets.

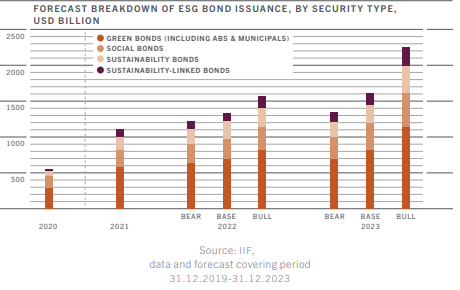

The International Energy Agency says investments in clean energy must rise to $4 tn annually by the end of the decade to effectively control global warming. As per data from the Institute of International Finance, $1.1 tn worth of new sustainable bonds were issued in 2021, taking the overall ESG bond market to $2 tn.

The problem statements

Pictet writes that raising money for meeting the UN Sustainable Development Goals (SDGs) is easier for developed countries. However, developing countries must rely on private finance to meet the funding gap — estimated at $2.5 tn per year. The asset manager says that while private funding is key in emerging economies, the world needs to set universal rules and standards for sustainable bonds. Additionally, convincing investors that ESG bonds are viable alternatives to standard government and corporate debt is another priority.

Owing to the international policy shift on climate change, ESG-linked financial products and services are growing rapidly. The ESG debt universe is expanding by volume as well as the range of activities it covers. Currently, there are different types of ESG-linked bonds available in the market — green bonds, social bonds, sustainability bonds, transition bonds and sustainability-linked bonds. Of these, green bonds have the biggest debt market of more than $1.34 tn. Sustainability-linked loans come in second place with a debt market of $542 bn. Whereas, sustainability-linked bonds have the lowest market share with a market of just $87 bn.

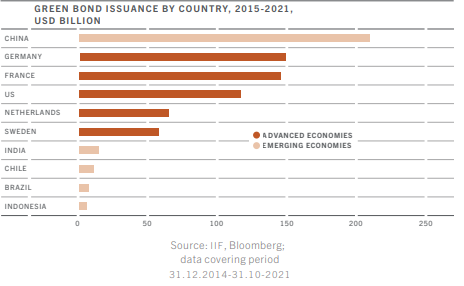

Green Bonds: Issuance of green bonds hit a record high in 2021, and they now represent 55% of the ESG-labelled bond markets, as per data from the International Institute of Finance, says Pictet. Germany, France and the US dominate the green bonds issuance market with a share of over one-third of the total green bonds market. In emerging markets, China, India, Chile and Brazil issue over 80% of green bonds. However, there is a flurry of activity in China, which leads the global bond market by issue size.

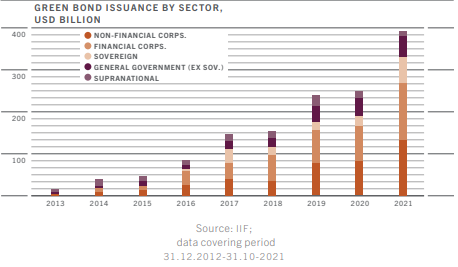

Green bond issuances were earlier limited to the public sector, but over the past decade issuance by financial and non-financial corporations has risen substantially. In 2019, financial firms issued 35% of the total green bonds, while utilities issued 17% and industrial companies issued 4%. Non-financial firms such as energy, consumer discretionary and materials sectors have the highest share and have stepped up green bonds issuance in recent years.

Nearly 50% of the green bonds issued have a euro denomination, followed by the USD (21%) and renminbi (8%).

While the green bonds market is valued in trillions, it is less than 1% fixed income securities. Investors fear that green bonds could be exploited by issuers and can be used for greenwashing. Pictet says while green bond issuance is poised to grow, there is a lack of a global investment framework. The report highlights the lack of coordination between issuing countries which may result in a fragmented market.

On the outlook for green bonds, Pictet sees annual issuance to top $1.2 tn by 2025, double of $560 bn sold in 2021.

Charting the rise of ESG-bonds

“Asset owners and the asset management industry will play a key role in providing the finance required to achieve the climate targets set in the Paris Agreement and broader sustainable development goals; their influence will be greater still in emerging markets and low-income countries,” Pictet says in its report.

Investor interest in ESG-bonds has already become apparent as over the past year ESG-aligned fund universe has grown over 65%, up from $1.5 tn to $2.5 tn.

However, ESG fixed income markets are a long way from reaching the scale to finance the transition of world economies to net-zero. Pictet writes that there should be global coordination to standardize certification for sustainable financial products around the world. Additionally, higher transparency by ESG rating agencies on their methodology could boost demand as well as supply of ESG debt securities.

“If world leaders are genuinely committed to net zero, they will also recognise that these ambitions require capital to flow freely. Which is why, in the battle against climate change, bond investors could soon find themselves in the front line,” Sonja Gibbs, Head of Sustainable Finance at Pictet said.

Read more

T. Rowe Price

Why US Treasuries may no longer be a safe haven

US Treasuries recent performance has fallen short of expectations.

Candriam

The euro bond market is back in focus

Rising yields and shifting fiscal dynamics are bringing the euro bond market back into focus.

Lombard Odier

EM equities – potential opportunities amid challenges

EM equities face renewed pressure amid US trade policy shifts, slowing growth, and investor outflows.

US Markets

100 days of Donald Trump

The first 100 days of Donald Trump’s second term have shaken markets. Asset managers weigh in on US equities, bonds, and the dollar.