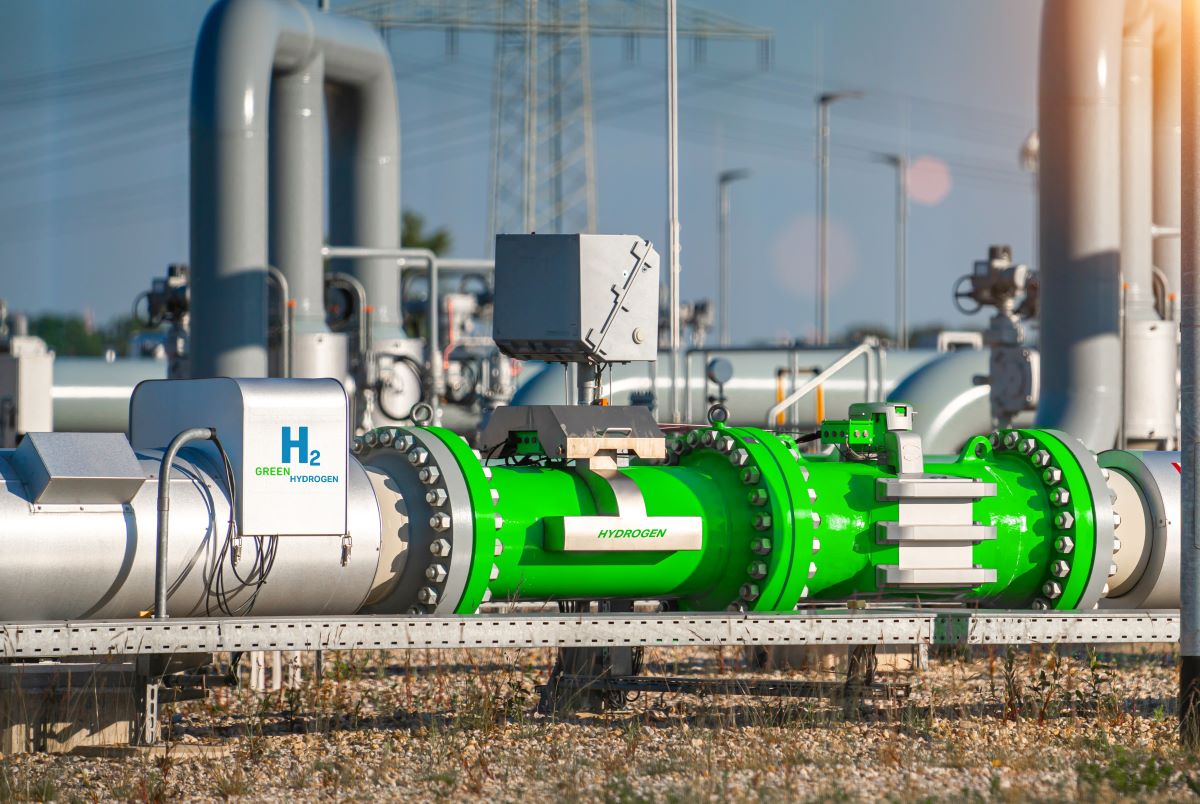

Investors are increasingly attracted to greener approaches for hydrogen production. Insight Investment explains that while most hydrogen is generated by natural gas via steam methane reforming and coal gasification, green hydrogen is produced by using an electrical current to disintegrate water molecules.

“Green hydrogen is crucial to achieve net zero, but its development and adoption face significant obstacles…,” contends the asset manager. Subsequently, it highlights that the cost of producing green hydrogen is much higher than hydrogen generated through other means. However, this is projected to fall materially by 2050.

Insight Investment also points to two main factors that are driving the price of green hydrogen more than fossil fuels. This includes the cost of renewable energy and carbon pricing.

Some of the other challenges for the development of green hydrogen include the requirement for new manufacturing, storage, and transportation supply chains. Accessing sufficient water resources is another area of challenge, as per the asset manager.

To tackle these challenges, Insight Investment suggests, “As the market evolves and scale increases, the best template could be liquified natural gas, where non-integrated third parties provide distribution and storage services.”

The asset manager also believes that policy support by the government plays a critical role in establishing the required infrastructure for green hydrogen generation. It further talks about the fact that nine countries responsible for 30% of global energy sector emissions have published national hydrogen strategies through 2021-22. These include the US, the UK, China, and European countries.

However, Insight Investment still says, “Nonetheless, aspects of green hydrogen costs (particularly transportation and storage) are likely to remain stubbornly high.” According to the asset manager, state support could also help to lower the risk premium for green hydrogen and unleash opportunities for impact-focused investors.

Insight Investment further opines, “For investors, price-support mechanisms for green hydrogen announced to date are heavily front-loaded, with a tapering of support towards 2030, driven by the intention to support the development of competitive marketplaces.” In this context, the asset manager highlights investment opportunities that include the green bond market and transition finance.

Read the complete insight here.

Read more

US Election

US election shake-up: What does it mean for markets?

“Risk assets might perform better under a Harris Presidency.”

Asia Equity

Why invest in Asia equity long/short now?

Investing in Asia has undergone significant changes in recent years. It might be the time for a different approach.

KKR

Multi-asset credit – the ‘all-weather’ strategy

Allocation to a multi-asset-credit strategy could optimise and manage risk dynamically.