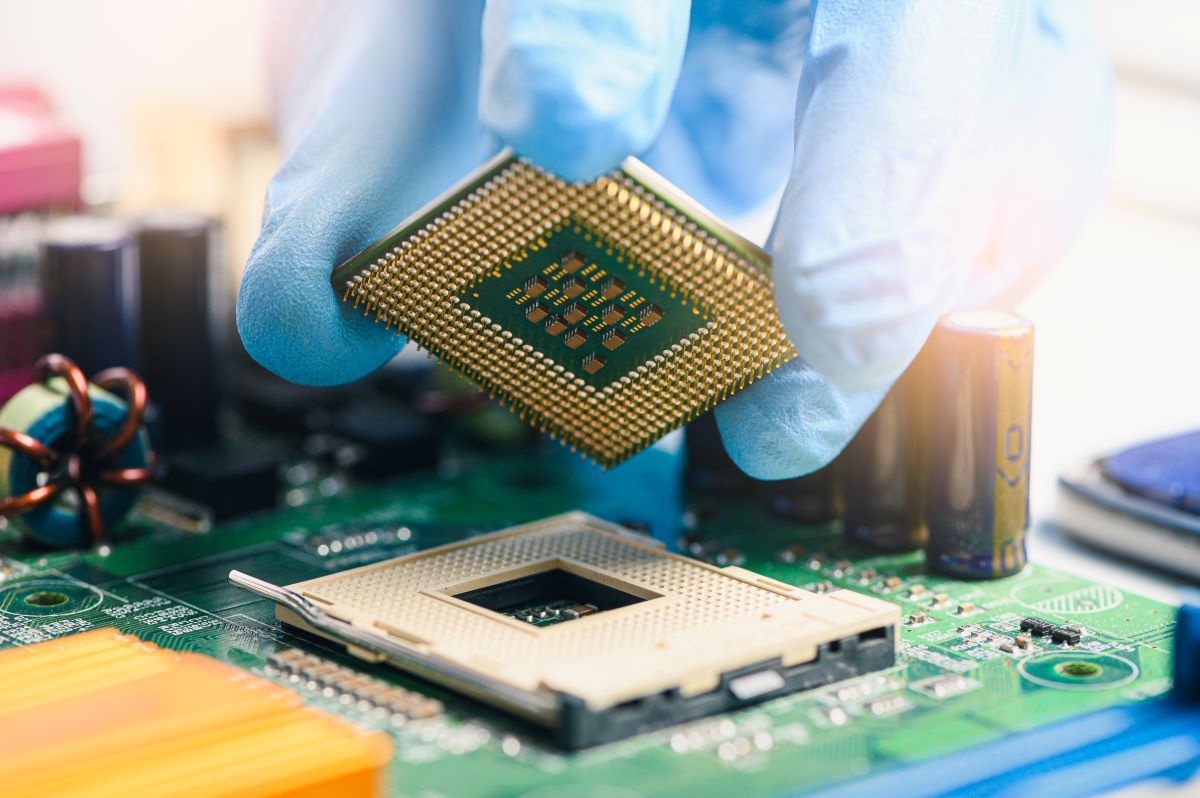

Semiconductors have become a critical element for renewable energy, electrified transport, and smart grids. However, they have seen the worst for several years post-pandemic, with dwindling demand and low prices. “Now, a combination of factors, including the prospect of massive new manufacturing plants, is set to boost both demand and supply,” says Arnout Van Rijn, Portfolio Manager with Robeco Multi-Asset Solutions. Subsequently, the asset manager points out that semiconductor stocks have rallied about 30% over the past 12 months, outperforming the global equity indices at 18%.

Rijn explains that after the total computing power of chips dropped to single digits in 2022 and 2023, they are all set for growth in 2024. “For 2024, a solid demand recovery is on the cards, supported by a PC upturn, the resumption of server growth, and the wave of enthusiasm for artificial intelligence (AI) that will likely add 5% alone to global bit demand,” he contends. Additionally, Robeco emphasises that the optimism for 2024 is driving the current performance for chipmakers.

Also, the asset manager stresses on the commodity-like features of semiconductors, like market pricing, fungibility, standardisation, and liquidity, as well as their trading patterns in global markets. However, Robeco opines that it is no longer a homogenous market.

Next, the asset manager highlights how global chip production is concentrated in Asia. However, the US and the European governments are offering large subsidies to domestic foundries to reduce dependency on China. The US Chips and Science Act and the European Chips Act are the two policies launched with this aim.

Meanwhile, Rijn also throws in a word of caution for the investors. “For thematic investors, the near-term outlook is not an easy call because an upturn may already be priced in, strong pricing power due to tight supply has passed its peak, and sales multiples have gone up,” warns Rijn. Despite this, the long-term outlook justifies a premium above historical averages for companies that have defensible intellectual property, he adds.

Furthermore, the asset manager is also upbeat about a futures market in memory chips. “It has differentiated cycles and thus offers nice diversification benefits. It can also offer insurance against any further geopolitical upheaval, just like oil used to do,” elucidates Robeco.

Read the full insight here.

Read more

City of London Investment Management

The case for Closed-End Funds in Emerging Markets

Closed-end funds have long been a niche investment vehicle, but what makes them particularly compelling in today’s emerging markets environment?

J.P. Morgan

The “golden era for gold”

Gold rallies on peaking yields, firm demand, and a weaker dollar outlook.

Apollo Multi Asset Management

Why absolute return matters more than ever

A disciplined absolute return strategy can deliver stability and low correlation in volatile markets.

HSBC Asset Management

Europe & EMs poised to eclipse U.S. equity dominance

Small caps in Europe and EM outperform, reversing years of large-cap dominance.