Dutch asset management firm Robeco in its recently published whitepaper “Pursuing SDGs in Emerging Markets” says emerging markets are lagging in achieving the UN Sustainable Developments Goals due to a lack of adequate financing. The firm gives a peek into strategies investors can use for funding companies driving a positive impact toward SGDs in emerging markets.

Climate change has forced corporates to realign their business models, but there is a wide gap in the impact investment figures for developed versus low-income developing countries. While environmental issues and goals are linear across the board, developing and low-income nations have a much higher spending requirement in ratio of their GDP, which is creating problems for achieving the common global goal of reducing carbon emissions.

Sustainable living is at the centre of the climate change debate, and in 2015, member states of the United Nations adopted 17 Sustainable Development Goals (SDGs) to promote sustainable economic growth, social inclusion while safeguarding the natural environment by the year 2030.

Same challenges, uneven progress

SGDs are applicable to every country regardless of their economic strength, as even the world’s richest countries too face issues such as environmental degradation, inequality, and pollution. Robeco says overall progress for meeting SDGs has been “far too slow” as global temperatures continue to rise, while the pandemic has reversed some of the progress made earlier.

According to the Dutch asset manager’s whitepaper “Pursuing SDGs in Emerging Markets”, developed economies generally fare better at achieving SGDs but face challenges with safeguarding natural environment and promoting sustainable agriculture. Meanwhile, sub-Saharan African and South Asian countries are likely to achieve climate action goals due to low greenhouse gas emissions, but face issues with ending hunger and providing people access to safe water and sanitation.

Why invest in emerging markets

Robeco’s research paper sees potential investment opportunities in the following spheres: Access to finance for everyone i.e., financial services, improved access to healthcare solutions through technology and infrastructure, nutrition and better agricultural productivity, renewable energy and sustainable land use.

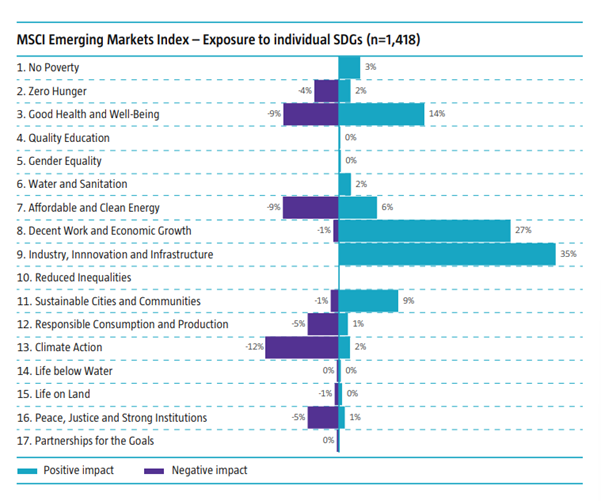

For the study, Robeco used its SDG Framework to analyse companies in the MSCI Emerging Markets Index. It found that 26% of firms have a negative impact, 22% make no significant contribution, and around 52% contribute positively towards achieving SDGs.

Here is a chart that shows the proportion of companies making positive and negative contributions to each SDG.

Based on Robeco’s study, the most negative impacts are found in SDGs linked to clean energy and climate, pollution, waste, overconsumption, people’s health, justice and tax evasion. The chart also shows that SDGs linked to education, equality and preservation of nature are the least invested in.

Meanwhile, SDGs linked to economic objectives (SDGs 8 and 9), health (SDG 3) and other basic needs (SDGs 2, 6, 7, 11), and the eradication of poverty (SDG 1) have the most positive impacts.

Robeco says SDG scores for emerging markets are similar to those for companies from a developed economy, unlike ESG ratings where emerging market companies perform worse. The reason is that ESG focuses on sustainability risk rather than sustainability performance. It considers the negative impact on revenue and profits due to environmental, social and governance issues.

Additionally, emerging markets generally have less developed regulations which increases ESG risk for companies, but Robeco says there is no clear rationale for this. On the other hand, SDG score proves to be a useful tool for sustainable investing in both emerging and developed economies.

Hurdles emerging markets face

While there is a horde of issues preventing emerging markets from achieving SDGs, the most significant hindrance is the poor access to financing. The International Monetary Fund (IMF) says that the world is not investing enough in SDGs and estimates that additional spending of $2.6 trillion a year is required up to 2030.

The spending requirement of each country is different, and IMF says emerging markets such as Guatemala and Indonesia need to spend an additional 4% of their 2030 GDP per year to attain these goals. Whereas low-income developing nations such as Vietnam, Rwanda and Benin need additional spending of about 15.4% of their 2030 GDP. In contrast, developed economies need additional investments below 1% of their 2030 GDP per year.

While financing activities to meet SDGs is one side of the story, it is also essential to stop funding activities that conflict with achieving these goals. Robeco says the challenge is to find ways of providing additional funding to countries while ensuring that there is no conflict.

SDG Investment opportunities in emerging markets

Robeco explores investment opportunities in the education and sanitation sectors, which have often been overlooked by the market. The firm considers companies with a market capitalization of at least $850 million to align with its investment strategy as part of a global equity fund.

Education

The study found that the number of children not attending school in low-income countries had not improved over the past two decades because the investment in education was not enough to keep up with the population growth. The situation has worsened during the pandemic due to poor access to online learning in developing nations.

Robeco estimates that global expenditure on education needs to triple to reach $3 tn annually by 2030 to achieve the education-linked SDG. While public spending can provide some support, investments from financial markets are essential to bridge the funding gap.

Sanitation

Close to a million people die in low and middle-income countries due to poor sanitation and lack of access to clean water. Good hygiene can prevent the spread of diseases and reduce spending on healthcare. WHO in a 2012 report said that every $1 spent on sanitation returned $5.50 due to reduced health costs, greater productivity and fewer premature deaths.

Developing economies are a huge market for manufacturers of household and personal care products, environmental service providers and water processing firms. Robeco says emerging markets will require investments in clean water and waste collection, and a lack of public funds provides plenty of opportunities for private players.

Existing statistics show that 2.3 billion people do not have access to both water and soap at home to wash their hands. Additionally, over 80% of wastewater generated from human activities is not treated before discharge. This untreated wastewater is used for irrigating global land parcels – that are collectively the size of Germany.

Read more

T. Rowe Price

Why US Treasuries may no longer be a safe haven

US Treasuries recent performance has fallen short of expectations.

Candriam

The euro bond market is back in focus

Rising yields and shifting fiscal dynamics are bringing the euro bond market back into focus.

Lombard Odier

EM equities – potential opportunities amid challenges

EM equities face renewed pressure amid US trade policy shifts, slowing growth, and investor outflows.

US Markets

100 days of Donald Trump

The first 100 days of Donald Trump’s second term have shaken markets. Asset managers weigh in on US equities, bonds, and the dollar.