x

7. February 2025

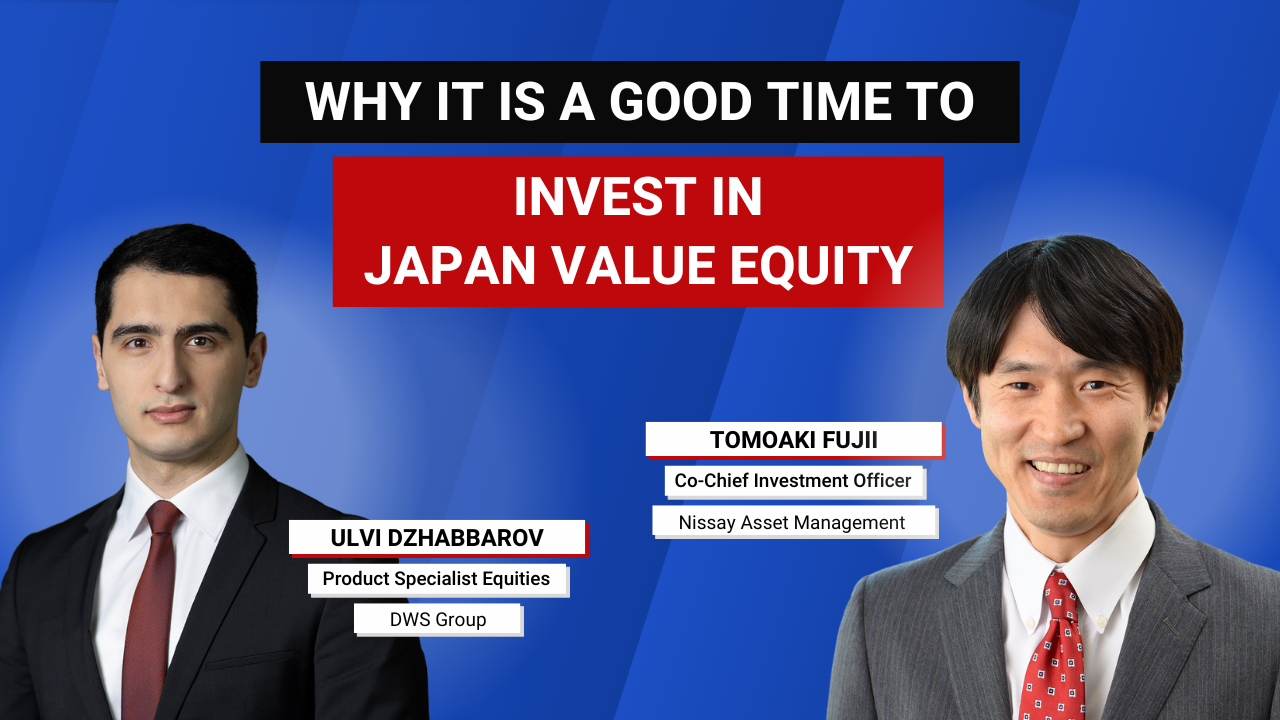

Japanese equities are gaining renewed attention as market reforms, corporate earnings, and government incentives create a promising investment landscape. In this Investment Talk, Ulvi Dzhabbarov, Product Specialist Equities at DWS Group, and Tomoaki Fujii, Co-Chief Investment Officer at Nissay Asset Management, discuss why Japan is an attractive market for value investors today.

From macroeconomic trends and policy impacts to the unique features of the DWS Concept Nissay Japan Value Equity Fund, they offer insights into why now might be the right time to focus on Japanese equities.

Ulvi Dzhabbarov has more than 5 years of experience in the financial industry. He joined DWS in 2021 and currently works as Product Specialist Equities, where he is responsible for the European Large-Cap and Japanese active equity strategies. Prior to joining DWS, Ulvi worked as a financial services consultant at KPMG.

Tomoaki Fujii, with over 20 years of asset management experience, has led equity research and portfolio management teams and gained overseas expertise. Since 2017, he has served as Co-Chief Investment Officer and, since 2021, as Head of ESG Investment, driving NAM's ESG research and engagement.

Thomas Schalow is the CEO of Capitalmarkets.net. He has over 25 years of experience in investment management, including various management roles at international investment firms. He publishes on financial topics and regularly moderates investment events.